Travel Insurance for Japan from India

When you're planning a trip from India to Japan, it's easy to overlook travel insurance amid flights and sightseeing plans. Still, without it, you risk facing unexpected costs from delays, lost baggage, or medical emergencies far from home. Japan’s healthcare can be expensive, and your regular policy likely won’t help abroad. Before you book your ticket, it's essential to know what truly matters when choosing the right coverage for your journey.

Overview of Travel Insurance for Japan

Travel insurance is an important consideration for Indian travelers planning a trip to Japan. Various insurance providers, such as AIG, Tata, and HDFC Life, offer policies that cater to a range of needs, including coverage for medical emergencies, baggage loss, and trip cancellations. Such coverage is particularly relevant due to the possibility of unforeseen incidents, which may occur in locations like temples or hot springs.

When selecting a policy, it is advisable to thoroughly examine the list of inclusions and exclusions to ensure comprehensive coverage. Notable aspects to review include provisions for critical illness and accidental death, as these can significantly impact a traveler’s experience.

Travelers should also familiarize themselves with the necessary documentation required for policy claims, which typically includes flight tickets and a completed proposal form. It is beneficial to assess premium costs and available plans to make an informed choice.

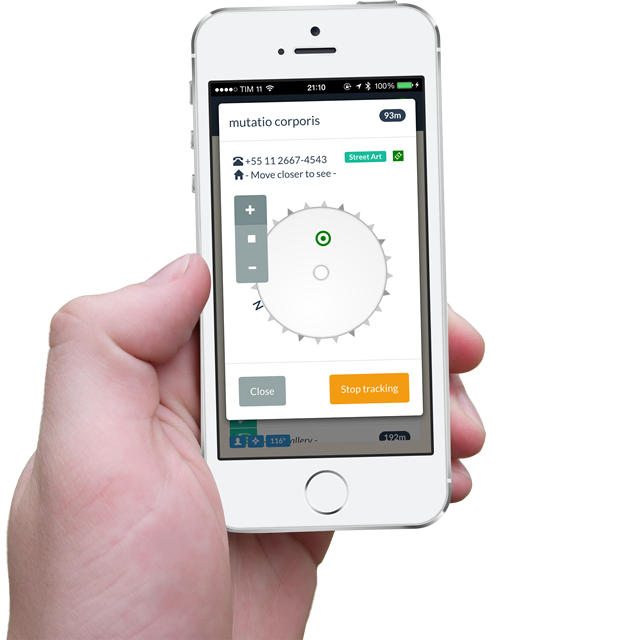

In case of challenges such as passport loss or flight cancellations, accessing customer support services and mobile applications can facilitate smoother resolutions.

Prior to finalizing a policy, it is recommended to carefully read the sales brochure to understand the terms and conditions applicable to the coverage. This due diligence will help travelers navigate potential risks more effectively during their journey.

Importance of Securing Coverage Before Travel

Securing travel insurance prior to departure is a prudent measure, particularly given the high healthcare costs in Japan. For travelers, including Indian nationals, the potential for unexpected expenses—such as medical emergencies, baggage loss, or trip cancellations—necessitates a thorough understanding of insurance options.

It is important to assess various policies critically. Utilizing comparison tools can facilitate an informed choice among insurers like AIG, Tata, and HDFC Life. Key factors to review include the specifics of coverage for medical emergencies, critical illness, and loss of documentation, such as a passport.

Prior to purchasing a policy, ensure that all necessary documentation—such as the proposal form, flight itinerary, and identification—are collected.

The availability of policy support and customer service can also influence the adequacy of coverage and provide essential assistance during travel. Overall, securing appropriate travel insurance contributes to mitigating financial risks associated with international travel.

Key Benefits of Japan Travel Insurance Plans

When planning a trip to Japan, it is important to recognize the role that travel insurance can play in protecting against unforeseen expenses and disruptions. Japan travel insurance typically includes medical coverage that can reach up to $200,000, which is crucial in cases of injury or illness during your trip.

Additionally, the coverage often extends to baggage loss, passport loss, and trip cancellations, which can all significantly impact travel plans.

Several companies, including AIG, Tata, and HDFC, offer policies specifically designed for various demographics, including Indian nationals, senior citizens, and travelers specifically visiting cultural sites such as temples, hot springs, or events like the Sapporo Snow Festival.

These policies often feature 24/7 customer support and claim assistance, which can be vital in addressing emergencies while abroad.

Moreover, the policies generally cover unforeseen circumstances, including accidental death, providing a measure of security for travelers.

It is advisable to thoroughly review both the inclusions and exclusions of any policy prior to purchase to ensure it aligns with your specific travel needs and risks.

Overall, adequate travel insurance can provide necessary reassurance and mitigate potential financial losses during a trip to Japan.

Coverage Details and Policy Exclusions

Comprehensive protection is a key component of most travel insurance plans for Japan, typically encompassing medical emergencies, trip cancellations, lost or delayed baggage, and personal liability.

When evaluating policies from providers such as AIG, Tata, HDFC Life, or others, it is imperative to closely examine both the inclusions and exclusions. Notably, many policies do not cover pre-existing medical conditions, self-harm, and activities that involve illegal acts.

In addition to standard coverage, certain policies may offer support for critical illnesses, accidental death, and complications arising from passport loss or baggage issues, which can be particularly beneficial in emergency situations. Utilizing an insurance calculator can assist in determining appropriate coverage levels.

It is advisable to thoroughly read the sales brochure and consult with customer support representatives to clarify any uncertainties prior to finalizing your policy.

Furthermore, a careful review of the policy documents is essential, especially for specific demographics such as travelers, senior citizens, and Indian nationals, as coverage options may vary significantly based on individual needs.

Types of Travel Insurance Plans for Indian Travelers

Travel insurance providers offer a variety of plans that cater to the diverse requirements of Indian travelers heading to Japan. Available options include individual, family, student, and frequent flyer policies from reputable companies such as AIG, HDFC, Tata, and others.

For senior citizens, there are specific plans that address concerns such as critical illnesses, emergency medical situations, and accidental death.

Comprehensive travel insurance plans typically encompass coverage for baggage loss, passport loss, and flight cancellations, which are significant aspects to consider given the unpredictable nature of travel. It is advisable for travelers to utilize insurance calculators, which allow for comparisons of coverage options and pricing across different plans.

When selecting a policy, it is essential to thoroughly review the sales brochure, paying attention to the inclusions, exclusions, and documentation required.

A clear understanding of these elements is crucial for making an informed decision. Additionally, many plans provide claim assistance, which can be beneficial in navigating the claims process during travel.

Overall, travel insurance serves as a valuable safety net, offering protection and peace of mind throughout the journey.

Add-On Options for Enhanced Protection

For travelers concerned about safety while visiting Japan, various add-on options are available to enhance standard travel insurance coverage. These options can include coverage for adventure sports, such as skiing, or specific protection for natural disasters, which is particularly relevant in regions prone to earthquakes.

Insurance providers like Tata, AIG, and HDFC offer a range of add-ons that may include coverage for pre-existing medical conditions, baggage loss, accidental death, and passport loss.

When selecting a policy, it is advisable to utilize a comparison calculator. This tool can help assess different plans, including their inclusions and exclusions.

It is also important to evaluate offerings from both Company Limited and Private Limited insurers.

Before finalizing any insurance purchase, prospective travelers should thoroughly review the sales brochure to ensure comprehensive understanding of the policy's terms and conditions. This step is crucial in ensuring adequate support and coverage in the event of unforeseen issues during the trip.

Japan Visa Requirements and Documentation

Before traveling to Japan from India, it is essential to ensure that you meet the visa requirements and have the necessary documentation. A valid passport is a primary requirement, which should have at least six months of validity remaining beyond your planned departure date from Japan.

In addition to the passport, applicants must submit a completed visa application form available from the Japanese Embassy in India, along with recent passport-sized photographs.

Financial documentation is also necessary to establish that you can support yourself during your stay. This typically includes bank statements or other evidence of financial means. Furthermore, your travel itinerary should be provided, which includes confirmed flight bookings and accommodation details.

A covering letter that outlines the purpose of your visit is also required. This letter should succinctly explain your travel plans, whether for tourism, business, or visiting family.

Additionally, it may be prudent to include travel insurance documentation. Travel insurance can be particularly beneficial, as it provides coverage for unforeseen circumstances, such as medical emergencies or lost baggage, which is of significance for all travelers but is especially recommended for senior citizens or those visiting more challenging destinations, such as temples.

Overall, careful preparation of these documents will facilitate a smoother visa application process.

Process for Purchasing Japan Travel Insurance Online

The process of purchasing travel insurance for a trip to Japan from India has become increasingly efficient due to advancements in digital platforms. Travelers can now complete the entire process online, which enhances accessibility and convenience.

To begin, it is advisable to visit reputable insurance providers such as TATA AIG, HDFC, or various other private insurers. These platforms typically offer a comparison tool, allowing users to evaluate different plans tailored for Indian travelers. Key coverage options to consider include medical emergencies, baggage loss, critical illness, and accidental death, as these factors are often significant concerns for international travelers.

Once you have selected a plan that meets your requirements, you will need to fill out a proposal form that includes essential details about your trip. This may also involve submitting supporting documents. It is essential to review the policy details thoroughly, paying particular attention to inclusions and exclusions specified in the sales brochure before finalizing the purchase.

After confirming the details, the payment process should be conducted securely to protect personal information. Once the transaction is complete, travelers can download their policy document. This documentation is crucial, as it provides necessary assurance against unexpected events during one’s journey, including visits to cultural sites and leisure facilities.

Steps for Filing a Claim from Japan

Timely action is critical when facing an incident during your travels in Japan. It is advisable to contact your insurance provider—such as TATA AIG, HDFC, or any relevant third-party insurer—within seven days of the incident.

In cases of theft, filing a police report is mandatory for claims related to lost baggage or passport issues, particularly in busy transit hubs like Narita International or Kansai International Airport.

It is important to retain all pertinent documentation, including medical reports, flight tickets, receipts, and the claim form itself, as these will be necessary for the claims process.

Additionally, claim assistance can be sought through the provider's mobile application or designated email address, particularly in situations involving injury or illness.

Upon completion of the review process, settlements can be credited directly to the accounts of claimants, including Indian nationals, senior citizens, or other travelers, which can facilitate a sense of security and reassurance during the resolution of the claim.

Essential Tips for Indian Tourists in Japan

To ensure a rewarding and smooth trip to Japan, thorough preparation is essential. One of the fundamental steps is to secure comprehensive travel insurance through reputable providers such as AIG, Tata, or HDFC Life. This insurance should adequately cover medical emergencies, trip cancellations, and potential baggage loss.

Indian travelers must also be diligent in organizing necessary documentation. This includes obtaining a visa from India, securing flight tickets, and completing any required proposal forms. It is advisable to review travel insurance plans meticulously to understand the coverage offered, especially in relation to Critical Illness and Accidental Death clauses.

Cultural respect is crucial during a visit to Japan; therefore, it is important to adhere to temple etiquette and comply with local laws. For transportation, the Japan Rail Pass is an economical option for long-distance travel, allowing tourists to navigate the extensive rail network with relative ease.

Additionally, saving emergency numbers, such as 119 for emergencies, is a proactive measure that should not be overlooked.

For senior citizens, it is prudent to choose insurance policies that provide benefits such as Peace of Mind, Claim Assistance, and support options for unforeseen events, including passport loss.

By attending to these details, Indian tourists can enhance their experience while minimizing potential challenges during their stay in Japan.

Conclusion

Before you set off for Japan, make sure you’ve got the right travel insurance in place. It’s more than a formality—it safeguards you from unexpected setbacks and gives you confidence to explore freely. From medical emergencies to lost baggage, your policy covers what matters most. Take the time to compare plans, understand the exclusions, and choose coverage that fits your needs. That way, you’re prepared for a smooth and worry-free trip from India to Japan.